In today's rapidly evolving business landscape, managing a diverse portfolio of companies with separate boards, CEOs and management teams is no small feat. It requires a keen eye for detail and a strategic approach. BoardClic’s Multi-Board Overview is here to make this task more manageable. It provides an effective overview of the performance across your entire portfolio, equipping you with comparative insights that enable confident and effective decision-making.

Gain deeper comparative insights

This product is your gateway to a deeper understanding of each BoardClic evaluation conducted across your portfolio. Assess the overall performance and compare the results between your boards or portfolio companies through the lens of BoardClic’s unrivalled benchmarks and indexes.

Adopt as an early warning system

Dissect your latest evaluation key findings and gain valuable insights into individual boards’ strengths and areas for potential enhancement. Moreover, by breaking down the evaluation into specific sections such as value creation, chair feedback, strategy and board composition, you will get a comparative overview of strengths and weaknesses. Use it to enable proactive intervention within your portfolio by identifying misalignments and potential issues before they escalate.

Set portfolio-specific benchmarks

Setting benchmarks is a cornerstone of progress. With this feature, you can compare multiple boards' performance against your own standards as well as its industry peers over time. This not only provides a clear snapshot of your current standing but also serves as a foundation for setting achievable goals.

Enable informed decision-making

Identifying and prioritising key objectives is vital for making data-driven decisions. Multi-Board Overview enables you to easily assess the performance of your top priorities. By delving into the results, you will address critical areas, drive change where it matters and facilitate strategy implementation across multiple boards or your portfolio.

Read more about how FSN Capital is harnessing the power of our Multi-Board Overview to promote growth, integrity and people.

Need more info? No problem, our experts are ready to talk to you whenever you are.

Ready to explore BoardClic?

Sign up to experience our free interactive demo today.

Data insights

3 April 2025

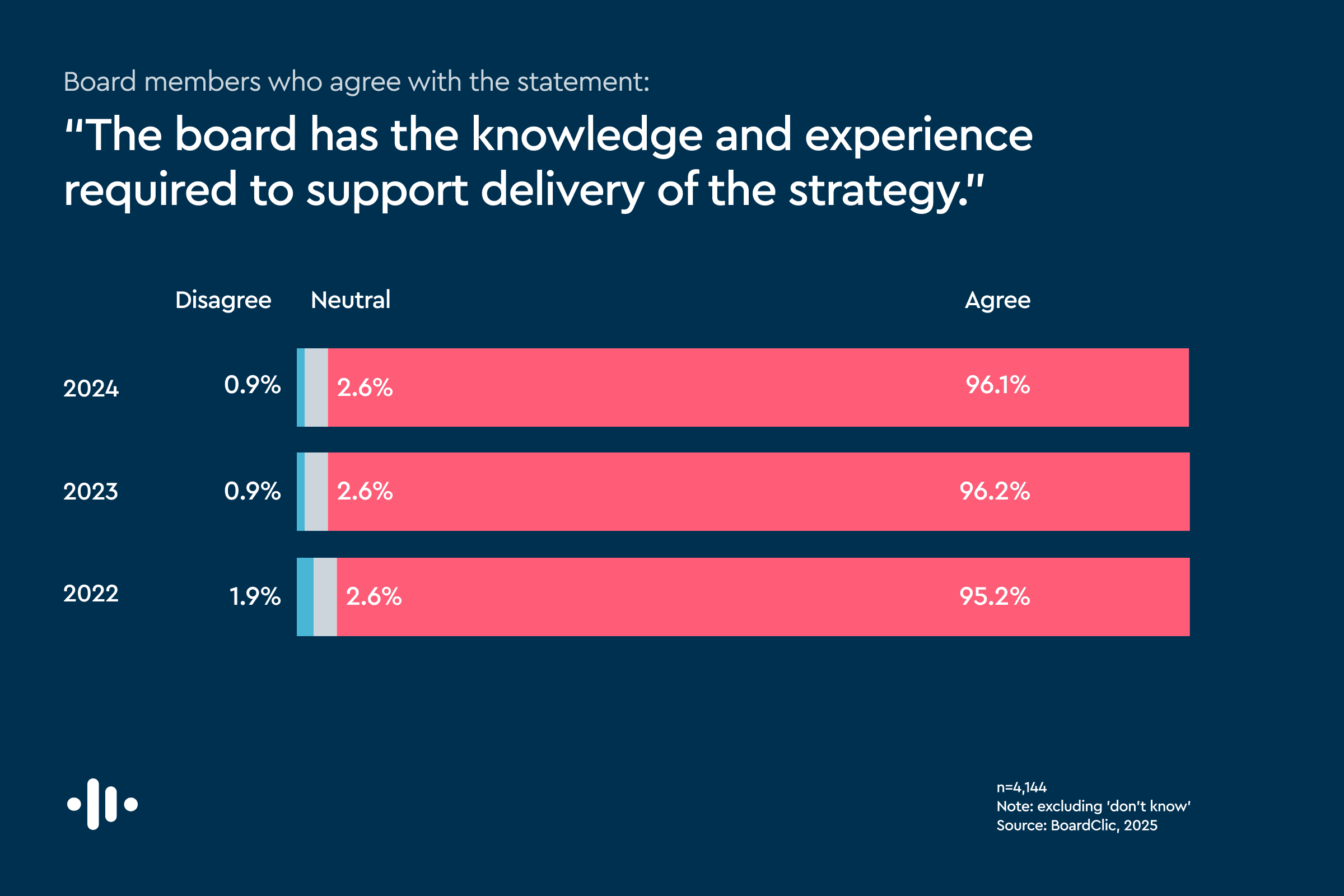

Beyond confidence as board composition defines effectiveness

Boards overwhelmingly trust their own expertise. They are confident that they have the knowledge and experience needed to support strategy. Year after year, this confidence remains high. But when it comes to diversity of backgrounds, our data reveals a different story.

Platform update

2 April 2025

Optimise board composition effortlessly with BoardClic’s Skills Matrix

In the fast-changing world of corporate governance, ensuring your board has the right mix of skills and competencies is crucial for sustained success.

Blog

20 March 2025